-

Phone:

+91 731-3684745 -

Email:

support@rafiloan.com -

Location:

310, 3rd Floor, Royal Gold, Opp. City Center, Y.N. Road, Indore (MP) 452003

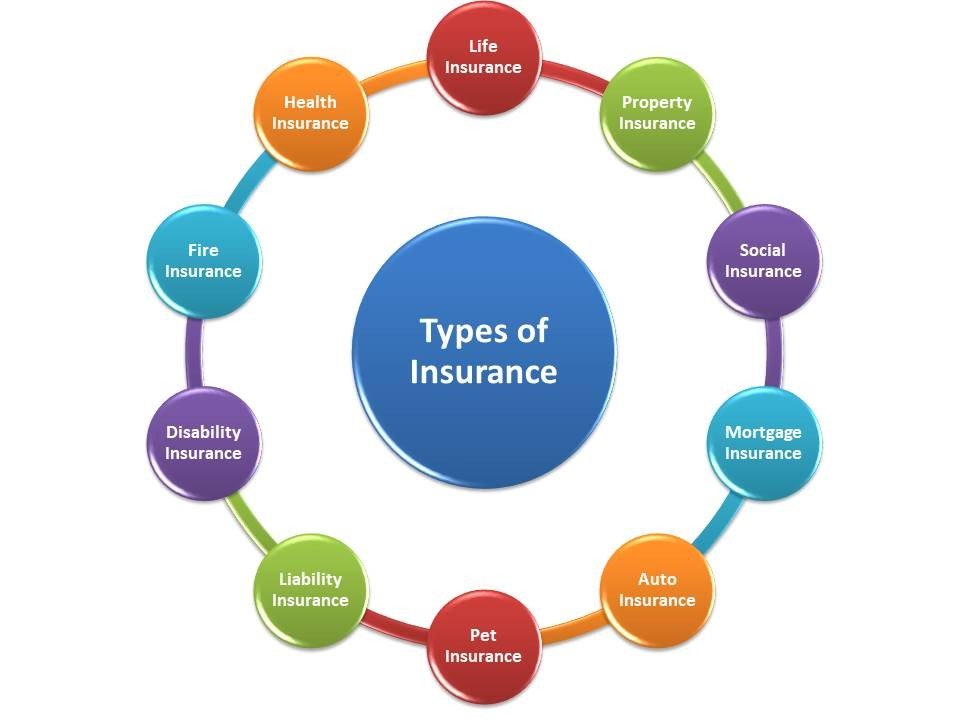

Insurance is a financial product designed to provide protection against potential future losses or damages. By paying a premium, policyholders transfer the risk of a significant financial loss to the insurance company. Here’s a brief overview of the key aspects of insurance:

Term Life Insurance: Provides coverage for a specific period. If the insured dies within the term, the beneficiary receives the death benefit.

Whole Life Insurance: Provides lifelong coverage with a savings component that accumulates cash value over time.

Endowment Plans: Provide a lump sum after a specified term or on death.

Covers medical expenses such as hospitalization, surgeries, and treatments.

May include coverage for critical illnesses, preventive care, and maternity benefits.

Liability Insurance: Covers damages caused to others in an accident.

Comprehensive Insurance: Covers damages to the insured vehicle due to accidents, theft, natural disasters, etc.

Personal Injury Protection: Covers medical expenses for the insured and passengers.

Covers damages to the home and personal property due to events like fire, theft, and natural disasters.

May include liability coverage for injuries occurring on the property.

Property Insurance: Covers damage to business property and assets.

Liability Insurance: Covers legal liabilities arising from injuries or damages caused by the business operations.

Business Interruption Insurance: Covers loss of income due to disruptions in business operations.

Financial Protection: Provides a safety net to cover unexpected expenses and losses, reducing financial stress.

Risk Management: Helps individuals and businesses manage risk by transferring it to the insurance company.

Legal Compliance: Certain types of insurance, like auto insurance, are mandatory by law.

Peace of Mind: Knowing that you have coverage in case of an emergency or loss provides security and peace of mind.

Typical documents required for a Insurance application include:

Personal Details:Full Name, Mobile Number, and E-mail id.

Proof of Identity: PAN card.

Proof of Address: Aadhar card.

Premium: The amount paid by the policyholder to the insurance company for coverage. It can be paid monthly, quarterly, annually, or as a lump sum.

Policyholder: The person or entity that owns the insurance policy.

Beneficiary:The person or entity designated to receive the insurance benefits in the event of a claim.

Coverage: The specific protection provided by the insurance policy, detailing what risks or losses are covered.

Deductible: The amount the policyholder must pay out-of-pocket before the insurance company pays a claim.

Claim: A request made by the policyholder to the insurance company for payment based on the terms of the insurance policy.

Exclusions: Specific conditions or circumstances that are not covered by the insurance policy.

Insurance is an essential part of financial planning, offering protection and peace of mind against life's uncertainties. Whether for individuals, families, or businesses, having the right insurance coverage is crucial for managing risks and ensuring financial stability.